Offshore Company Formation: Your Path to International Success

Offshore Company Formation: Your Path to International Success

Blog Article

Strategies for Cost-Effective Offshore Company Development

When taking into consideration offshore firm formation, the mission for cost-effectiveness comes to be a critical problem for organizations looking for to increase their procedures globally. In a landscape where fiscal carefulness reigns supreme, the approaches utilized in structuring offshore entities can make all the difference in attaining monetary efficiency and functional success. From browsing the complexities of jurisdiction option to implementing tax-efficient structures, the trip towards establishing an overseas existence is raging with obstacles and possibilities. By discovering nuanced strategies that mix lawful compliance, monetary optimization, and technological improvements, businesses can begin on a course towards overseas company formation that is both financially sensible and tactically audio.

Picking the Right Territory

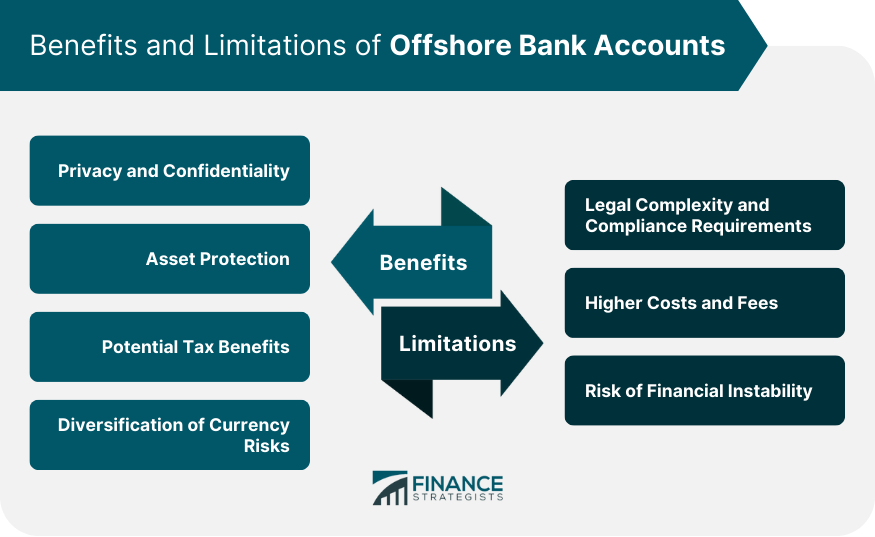

When developing an overseas business, selecting the appropriate jurisdiction is a crucial decision that can dramatically impact the success and cost-effectiveness of the development procedure. The territory picked will certainly determine the governing framework within which the company runs, impacting taxation, reporting needs, privacy regulations, and total service versatility.

When selecting a territory for your offshore business, several factors need to be taken into consideration to guarantee the decision straightens with your tactical objectives. One crucial facet is the tax obligation regimen of the territory, as it can have a substantial effect on the business's profitability. Additionally, the level of governing conformity called for, the political and economic security of the territory, and the ease of operating has to all be evaluated.

Additionally, the credibility of the jurisdiction in the global company neighborhood is important, as it can influence the perception of your company by clients, partners, and banks - offshore company formation. By thoroughly examining these factors and seeking expert recommendations, you can pick the appropriate jurisdiction for your overseas firm that optimizes cost-effectiveness and supports your service goals

Structuring Your Business Efficiently

To make certain optimum performance in structuring your offshore business, careful focus must be provided to the business framework. The first step is to specify the company's ownership framework clearly. This consists of figuring out the police officers, directors, and investors, in addition to their obligations and functions. By developing a transparent ownership structure, you can make certain smooth decision-making processes and clear lines of authority within the firm.

Following, it is important to consider the tax ramifications of the picked framework. Different jurisdictions provide differing tax advantages and rewards for overseas firms. By meticulously assessing the tax obligation legislations and regulations of the picked jurisdiction, you can maximize your company's tax obligation performance and lessen unnecessary costs.

Additionally, keeping correct paperwork and documents is important for the effective structuring of your overseas firm. By maintaining precise and up-to-date records of financial deals, business decisions, and conformity papers, you can make certain transparency and accountability within the organization. This not only helps with smooth procedures however likewise helps in showing conformity with regulatory needs.

Leveraging Modern Technology for Savings

Effective structuring of your overseas firm not just pivots on precise attention to organizational frameworks however additionally on leveraging technology for financial savings. One way to utilize innovation for financial savings in overseas company development is by utilizing cloud-based solutions for data storage and collaboration. By incorporating modern technology tactically into your overseas company development process, you can accomplish considerable cost savings while boosting functional performance.

Lessening Tax Obligation Obligations

Making use of tactical tax planning techniques can properly minimize the economic worry of tax responsibilities for overseas firms. Additionally, taking benefit of tax obligation motivations and exceptions used by the jurisdiction where the overseas company is registered can result in significant cost savings.

Another strategy to lessening tax obligation liabilities is by structuring the offshore business in a click to read tax-efficient fashion - offshore company formation. This entails very carefully making the possession and functional structure to optimize tax benefits. Setting up a holding business in a territory with positive tax obligation laws can assist reduce and combine revenues tax exposure.

Furthermore, remaining upgraded on global tax obligation policies and conformity demands is vital for reducing tax obligation liabilities. By ensuring strict adherence to tax obligation legislations and policies, offshore business can stay clear of expensive fines and tax obligation disagreements. Seeking specialist recommendations from tax consultants or legal professionals focused on global tax obligation matters can additionally offer useful insights right into efficient tax obligation preparation approaches.

Guaranteeing Compliance and Risk Mitigation

Implementing robust compliance actions is crucial for overseas firms to minimize threats and maintain regulatory adherence. Offshore jurisdictions frequently encounter enhanced examination as a result of worries pertaining to money laundering, tax evasion, and other economic criminal offenses. To make certain conformity and alleviate dangers, offshore firms ought to carry out comprehensive due diligence on clients and company companions to protect against participation in immoral tasks. Additionally, applying Know Your Client (KYC) and Anti-Money Laundering (AML) treatments can help confirm the legitimacy of purchases and secure the company's view it now online reputation. Regular audits and reviews of financial documents are important to identify any irregularities or non-compliance issues quickly.

Additionally, staying abreast of changing regulations and lawful needs is vital for overseas business to adjust their conformity techniques accordingly. Involving legal professionals or conformity professionals can give beneficial advice on browsing complicated regulatory landscapes and ensuring adherence to international standards. By focusing on conformity and risk reduction, offshore business can improve openness, build trust fund with stakeholders, and guard their operations from possible lawful repercussions.

Conclusion

Utilizing strategic tax obligation planning strategies can effectively lower the financial burden of tax responsibilities for offshore companies. By dispersing earnings to entities in low-tax jurisdictions, offshore companies can legitimately reduce their general tax obligation commitments. In addition, taking benefit of tax incentives and exemptions provided by the territory where the overseas firm is registered can result in considerable savings.

By making certain stringent adherence to tax legislations and laws, offshore firms can prevent costly fines and tax disputes.In final thought, affordable offshore company formation calls for site here cautious factor to consider of territory, efficient structuring, innovation use, tax obligation reduction, and conformity.

Report this page